The Internal Revenue Service (IRS) has recently made headlines with its decision to purchase an AI supercomputer from Nvidia, a leading technology company. This move has sparked curiosity and speculation about how exactly the IRS will utilize this advanced technology. While the specifics are still unclear, one thing is for certain: the IRS is joining the growing trend of government agencies incorporating automation into their operations.

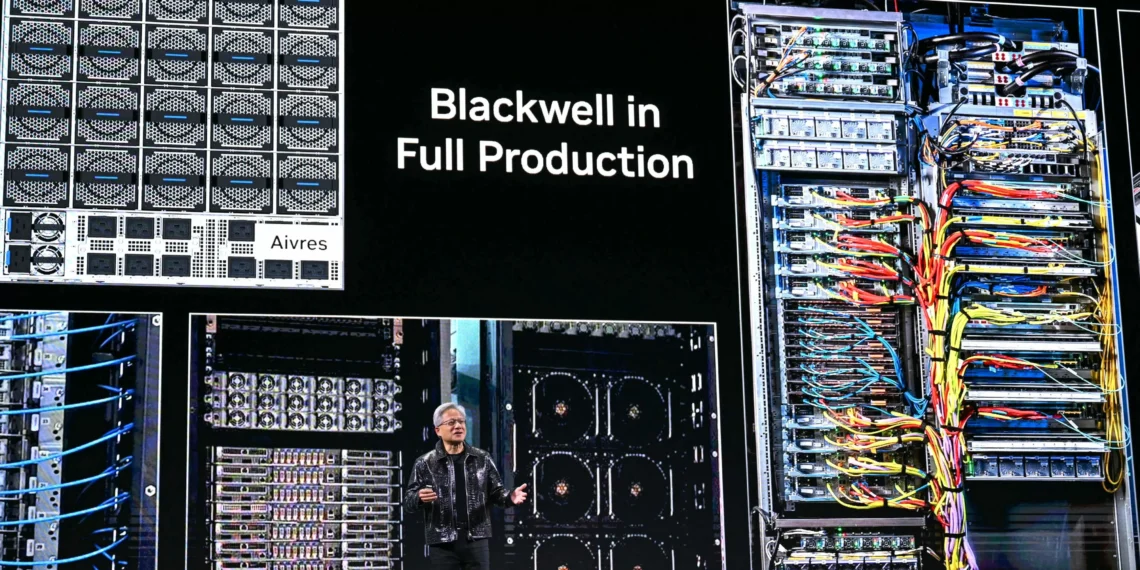

The SuperPod AI hardware, developed by Nvidia, is a powerful machine that combines the capabilities of artificial intelligence and high-performance computing. With its state-of-the-art processors and advanced algorithms, the SuperPod is capable of processing vast amounts of data and performing complex tasks at lightning speed. This makes it an ideal tool for organizations that deal with large amounts of data, such as the IRS.

So, how exactly will the IRS use this cutting-edge technology? While the agency has not revealed its specific plans, experts believe that the SuperPod will be used to improve the efficiency and accuracy of tax processing. With the ability to analyze and interpret massive amounts of data, the SuperPod can help the IRS identify patterns and anomalies that may indicate tax fraud or other illegal activities. This will not only help the agency catch tax evaders but also ensure that honest taxpayers are not unfairly burdened.

The decision to embrace AI technology is a significant step for the IRS, which has been facing challenges in keeping up with the increasing complexity and volume of tax-related data. With the SuperPod, the agency will have a powerful tool at its disposal to handle this data more effectively. This will not only save time and resources but also enable the IRS to make more accurate decisions and provide better services to taxpayers.

The move towards automation in government is not a new phenomenon. In recent years, we have seen various agencies and departments incorporating AI and other advanced technologies into their operations. For instance, the Department of Defense has been using AI to analyze satellite images and identify potential threats. The Department of Health and Human Services is using AI to improve healthcare services, and the Department of Transportation is exploring the use of AI to enhance traffic management. With its decision to purchase the SuperPod, the IRS is now joining this wave of technological advancement in the public sector.

The benefits of embracing AI in government are numerous. Apart from improving efficiency and accuracy, AI can also reduce the risk of human error and bias in decision-making. It can also free up employees’ time, allowing them to focus on more complex and meaningful tasks. Furthermore, AI can help government agencies identify and address issues more quickly, leading to better outcomes for citizens.

However, as with any new technology, there are concerns about the potential impact of AI on jobs. With the SuperPod, the IRS will undoubtedly be able to process tax-related data more efficiently, but this does not mean that human employees will be replaced entirely. On the contrary, AI technology will likely create new job opportunities and require a workforce with different skills. The IRS has assured that the SuperPod will not lead to job losses, and instead, it will help employees focus on more value-added tasks.

In conclusion, the IRS’s decision to purchase an AI supercomputer from Nvidia is an exciting development in the world of government technology. It marks a significant step towards embracing automation and leveraging the power of AI to enhance operations and better serve citizens. While the exact use of the SuperPod is still uncertain, one thing is clear – the IRS is committed to staying at the forefront of technology and utilizing it to improve its services. As we continue to see more government agencies incorporating AI and other advanced technologies, we can look forward to a more efficient, accurate, and responsive public sector.