As the global economy continues to fluctuate and traditional markets experience volatility, Congress has turned its attention to a new sector: cryptocurrency. While many may view this as a promising step towards financial stability, there are concerns that the push for cryptocurrency is being driven by the Trump family’s financial interests.

Cryptocurrencies, or digital currencies, have been gaining popularity in recent years as a decentralized and secure alternative to traditional currencies. The most well-known cryptocurrency is Bitcoin, but there are now thousands of different cryptocurrencies in circulation.

One of the latest developments in the world of cryptocurrency is the emergence of “stablecoins.” These are cryptocurrencies that are backed by traditional assets, such as fiat currency or commodities, in an attempt to provide stability and reduce volatility in the market. And it seems that Congress has taken a keen interest in this new form of digital currency.

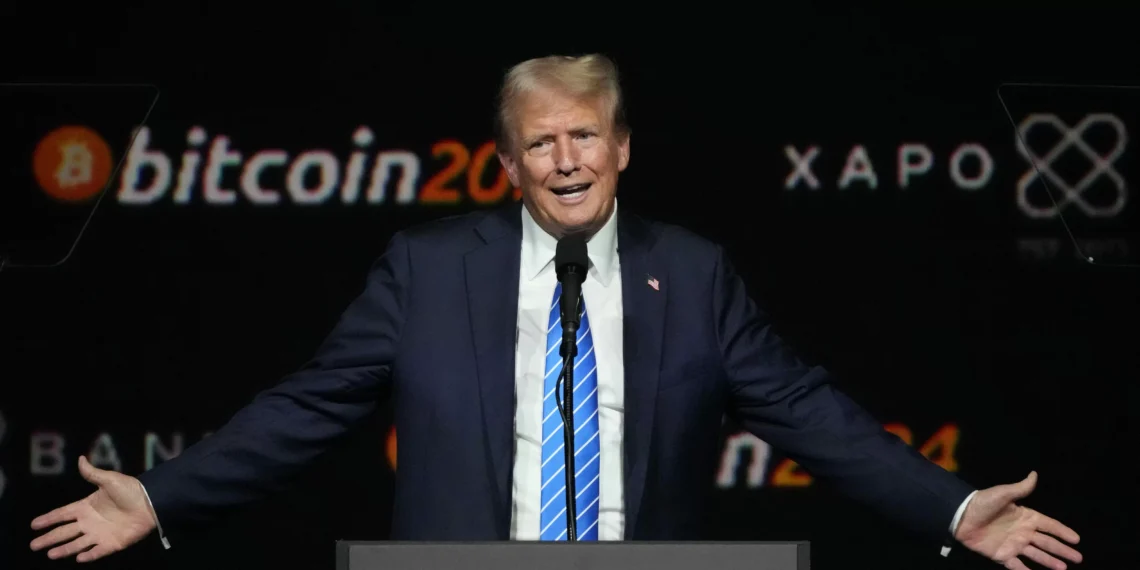

But why is Congress suddenly prioritizing stablecoins over other pressing financial issues? The answer may lie in the fact that the Trump family has significant financial ties to the stablecoin industry.

In particular, the Trump family has close connections to Tether, one of the largest stablecoin companies. Tether has been under investigation for years over allegations that it artificially inflated the value of its stablecoin, which is supposed to be pegged to the US dollar. And now, with Congress pushing for stablecoins to be regulated and recognized as a legitimate form of currency, the Trump family stands to benefit greatly from this new market.

It’s no secret that the Trump family has a history of using their political power for personal financial gain. And the fact that they have such a vested interest in the stablecoin market raises red flags about Congress’s true intentions.

But what exactly is Congress’s end goal with stablecoins? And why is it such a priority for them?

One possible reason is that stablecoins could potentially provide a solution to the current economic crisis caused by the ongoing pandemic. With traditional markets crashing and economies struggling, stablecoins could offer a lifeline for businesses and individuals looking for a stable and reliable form of currency.

Additionally, with the rise of digital currencies, there is a growing concern over the potential loss of control by central banks and governments. By regulating stablecoins, Congress could maintain some level of control and oversight over the digital currency market, avoiding any potential threats to their power and influence.

But despite these potential benefits, there are also valid concerns about the stability and security of stablecoins. As with any new technology, there are still many uncertainties and risks involved. And the fact that the Trump family is involved in one of the leading stablecoin companies only adds to these concerns.

In the end, it’s crucial for Congress to prioritize the well-being of the general public over their own financial interests. While stablecoins may offer some solutions to the current economic crisis, it’s essential to approach this new market with caution and transparency.

It’s time for Congress to prioritize the needs of the people over their own personal gain. The focus should be on finding practical and sustainable solutions to the current economic challenges, rather than pushing for a sector that may benefit a select few.

In conclusion, the sudden shift in Congress’s financial priorities towards stablecoins raises valid questions about their true intentions. And with the Trump family’s financial involvement in the stablecoin industry, it’s crucial for Congress to act with transparency and prioritize the public’s best interests. Let’s hope that Congress will make the right decision and not let personal gain cloud their judgment. After all, the well-being of the economy and its people should always be the top priority.